Investor Perspectives on the Global Sports Landscape

We dive into Chapter 3 of the Altman Solon's 2024 Global Sports Survey, navigating investment opportunities in the evolving sports landscape.

Hello sports tech enthusiast! 👋🏼 Welcome to Regen Sports, your twice-weekly deep dive into the intersection of sports and technology. Every Monday, catch up on the week's most important developments in sports innovation, and every Thursday, explore in-depth analysis of trends, companies, and technological breakthroughs reshaping the future of sports.

Welcome to our breakdown of chapter 3 from Altman Solon's 2024 Global Sports Survey. Following on from last week’s second chapter, this is the third instalment in our series where we explore key findings from this comprehensive industry report.

If you missed them, previous chapters in this series:

Chapter 1: "Winning Tomorrow's Sports Fans" – Insights on engaging digital-native audiences

Chapter 2: "Rethinking Sports Rights Monetisation" – Strategies for maximising value from sports media rights

Global Sports Survey Overview

The survey continues its mission to give voice to all stakeholders in the sports sector. This third chapter of five focuses specifically on investor perspectives within the evolving sports media landscape.

The research methodology included:

Online surveys with 220 senior sports executives globally (rights owners, media distributors, and investors)

Consumer research with approximately 3,000 sports fans across five countries: the U.S., U.K., Germany, Saudi Arabia, and China

Data collection between June and September 2024, with additional consumer insights from GWI

Investor Perspectives: Expanding Beyond Traditional Boundaries

The survey highlights a key shift in investment focus. While historically, investments in sports have primarily targeted IP owners such as teams and leagues, there's now growing recognition of opportunities across the wider sports ecosystem, especially along the fragmented sports media tech value chain. Investors are increasingly looking beyond acquiring stakes in sports teams to consider the potential in technology service providers.

According to the executives surveyed:

62% believe technology solution providers represent the most attractive investment opportunity, reflecting the industry's ongoing digital transformation

41% see sports clubs and franchises as attractive investments, viewing them as stable assets despite an increasingly competitive transaction environment

These providers are benefiting from the evolving needs of media rights owners and traditional broadcasters as they navigate new forms of value creation and distribution. The sports media technology value chain, encompassing production, transport, and distribution, is estimated to be a significant market, presenting various sub-segments with growth potential. The fragmented nature of this ecosystem also provides opportunities for consolidation, as illustrated by recent deals like TGI Sport's acquisition of Supponor.

"Investors must focus on organisations willing to diversify their revenue sources beyond traditional avenues." - Jamie Corr, Managing Director Sports at Burson

The survey notes that sports as an asset class presents a compelling risk-return profile, characterised by reduced downsides due to regulated monopolies and strong fan loyalty, alongside significant upsides from digital shifts and growing valuations.

The report also emphasises that growing deal flow and the diversification of investor types, including private equity and sovereign funds (beyond traditional wealthy individuals), are driving competition for assets. Investors are increasingly needing to differentiate themselves through access, expertise, and potential portfolio synergies. Case studies like Formula 1 and City Football Group demonstrate the potential for value creation through investment, enabling significant revenue growth by leveraging new geographies, enhancing media engagement, and embracing technology.

Sports Rights Monetisation: Navigating Disruption

The survey highlights a critical disruption in the traditional sports rights model: streaming platforms currently cannot generate the same level of revenue from sports rights as traditional broadcast models. This limitation is forcing a fundamental shift away from legacy approaches toward new distribution and monetisation strategies.

Media rights owners are actively exploring innovative avenues for value creation and rights exploitation, including:

Development of Over-The-Top (OTT) solutions

Creation of interactive content to enhance fan engagement

Establishing direct-to-consumer offerings

The Formula 1 case study illustrates this evolution perfectly. F1's strategic approach included securing rights deals with broadcasters like ESPN in new markets while simultaneously launching their own direct-to-consumer global offering, F1 TV. These initiatives contributed significantly to F1's revenue growth and demonstrate how rights owners can diversify their distribution channels.

From an investment perspective, technology solution providers that support these new monetisation strategies represent particularly attractive opportunities. These companies offer solutions that address key value drivers for media rights owners and broadcasters:

Improved content production

Enhanced content protection

Better engagement tools

New monetisation mechanisms

The report suggests that the industry can navigate this transition by leveraging new drivers such as artificial intelligence and private investment, especially in regions like the Middle East where sports are experiencing significant growth.

Image source: Formula 1

Technology Innovation: Reshaping the Sports Media Landscape

Another fundamental driver of the transformative journey within the sports media industry is technology innovation. A significant aspect of this is the emergence and importance of technology service providers in the sports media tech value chain.

These providers are seen as highly attractive investment opportunities, as mentioned in the previous point above. This attractiveness stems from the fact that these companies benefit directly from the digital disruption impacting media rights owners and traditional broadcasters.

The survey highlights that sports executives expect digital transformation to benefit most from private investment (58%). This digital transformation is intrinsically linked to technological innovation across various aspects of the sports media ecosystem.

The sports media technology value chain, which includes production, transport, and distribution, is particularly interesting for investors due to the opportunities and growth enabled by technological innovation affecting media rights owners and broadcasters.

Examples from the report illustrate the impact of technology innovation:

Formula 1's partnership with AWS demonstrates the use of technology to unlock capabilities like driver data collection and analysis, as well as advanced AR overlays during broadcasts, significantly improving the media experience.

City Football Group's involvement in e-sports and their global partnership with Cisco to drive innovation and enhance connectivity for their clubs showcase the diverse ways technology is being integrated into sports operations and fan engagement.

The report notes that a significant number of segments within the sports media value chain are expected to grow, fuelled by technological advancements. These segments include areas like automated production, IP delivery, media processing, content augmentation, and gamification. This growth provides market tailwinds for technology solution providers.

Furthermore, the survey points out that the current ecosystem is fragmented, which presents opportunities for consolidation among technology service providers. Recent deals, such as TGI Sport's acquisition of Supponor (a virtual advertising tech provider) and Spiideo receiving capital for expansion in AI-driven sports video analysis, exemplify this trend.

The survey underscores that technology innovation is not merely an add-on but a central force reshaping the sports media industry. It is driving new investment opportunities, transforming how sports content is produced, distributed, and consumed, and enabling new forms of fan engagement and monetisation. Investors are increasingly recognising the potential of technology solution providers to capitalise on these changes and are looking for organisations that can leverage technology to drive efficiency, create new revenue streams, and enhance the overall sports experience.

"The key is to invest in technologies that can shift the commercial model and scale effectively." - Roger Hall, CEO of uniqFEED

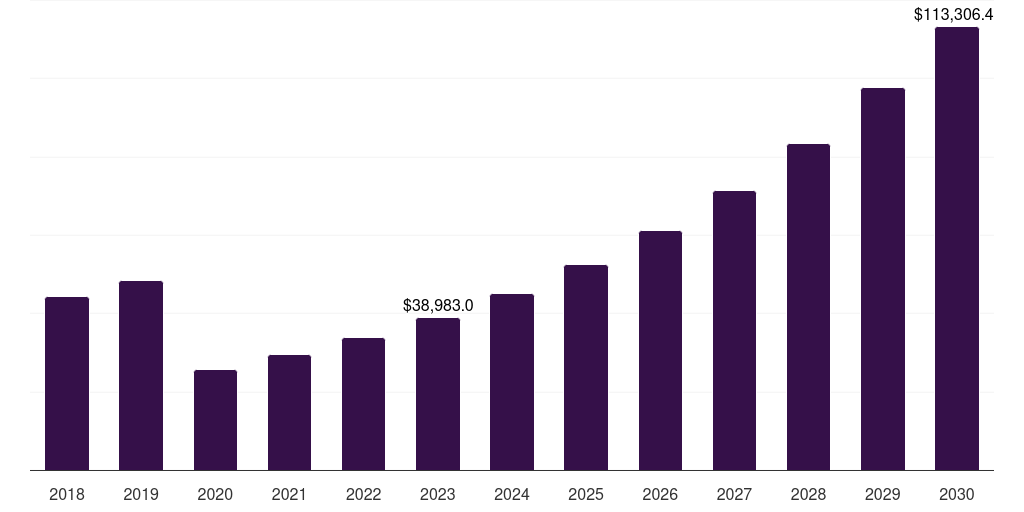

Image source: Middle East & Africa Sports Tourism Market Size from Horizon Grand View Research

Middle East Growth: A Rising Force in Global Sports Investment

The last key topic in the survey highlights the unprecedented sports growth in the Middle East, as expanded upon in this article from PWC, as a significant factor driving the transformative journey of the sports media industry. This growth is closely linked to a steady wave of private investment, particularly from the Middle East, which is identified as one of the new drivers for the industry's transition.

The survey provides several concrete examples of this investment and its impact:

Saudi Arabia's Public Investment Fund (PIF) has been actively involved in major sports deals, including a framework agreement to merge the PGA TOUR and LIV Golf. This indicates a significant influence on the global landscape of professional golf.

The PIF also undertook the takeover of Newcastle United, a prominent English Premier League football club.

Furthermore, the PIF invested over $1 billion in a new venture with the PGA Tour and LIV Golf, demonstrating a substantial financial commitment to shaping the future of golf.

SRJ Sports Investment fund, backed by the Saudi PIF, was also launched, signalling further investment in the sports sector from the region.

Qatar Investment Authority (QIA) has also made significant investments, such as acquiring a minority stake in the Formula 1 team Sauber, which will become Audi's factory team in 2026.

These examples underscore the increasing role of Middle Eastern entities, particularly sovereign wealth funds, in the global sports investment landscape. The report mentions that the types of investors in sports have diversified, with increased investment from sovereign funds in international sports being a notable trend.

While not exclusively focused on the Middle East, the advice from Royston Lasrado, Strategy Director, Asian Cup 2023, to tap newer markets such as Asia and Africa which have huge potential, also indirectly points to the growth opportunities in regions like the Middle East that are experiencing significant sports development. As echoed below;

"Investing in technologies like AI and machine learning to enhance fan experiences and tapping into newer markets in Asia and Africa offers significant potential."

In summary, the survey indicates that the Middle East is a key region experiencing significant and unprecedented growth in the sports sector, largely fuelled by substantial private investment from sovereign wealth funds. This investment is having a tangible impact on major global sports properties and signifies the region's increasing importance in the future of the sports industry.

Final Thoughts

The third chapter of the survey provides valuable insights into how investor perspectives are shaping the future of sports. From the expansion of investment focus beyond traditional IP owners to the growing importance of technology solution providers, a picture is painted of an industry in transformation.

The challenges in sports rights monetisation are pushing media companies to explore new distribution and value creation strategies, while technological innovation continues to be a fundamental driver reshaping how sports content is produced, distributed, and consumed.

Meanwhile, the Middle East has emerged as a powerful force in global sports investment, with sovereign wealth funds making significant impacts across multiple sports properties. As investors navigate this evolving landscape, those who can develop a nuanced understanding of the sports ecosystem, conduct thorough due diligence, and define clear strategies for asset optimisation will be best positioned to create value in this dynamic market.

Stay tuned for Chapter 4: AI & Innovation next week, where we'll explore how artificial intelligence and other emerging technologies are revolutionising the sports industry.

Track the Trends. Spot the plays. Shape the game.

Thanks for reading,

Dean

P.S. If you found this newsletter valuable, please share it with colleagues who might benefit from these insights. The sports tech industry grows stronger when we learn together.